Synchron has secured $200 million in Series D funding, bringing its total to $345 million and solidifying its position as a leader in the rapidly evolving brain-computer interface (BCI) space. The company, founded by Thomas Oxley, is not just raising capital; it’s doubling down on its long-term vision: to unlock the brain’s computational power in ways previously unimaginable.

This latest round isn’t just about scaling up; it’s a strategic move to accelerate clinical trials and expand operations, notably with a new facility in San Diego. Synchron isn’t simply building a product; it’s constructing a playbook for the entire BCI field, one that others will follow, remix, or react to.

From Breakthrough Designation to Billion-Dollar Valuation

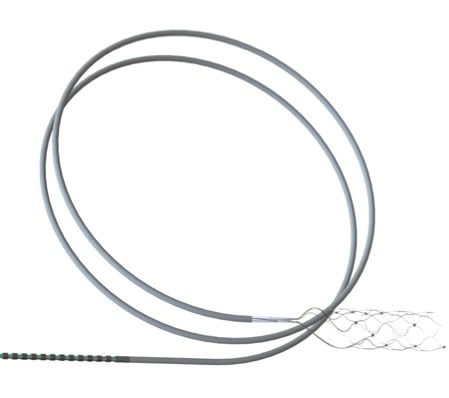

Synchron’s journey began in 2019, but the past five years have been marked by relentless progress. The FDA granted Breakthrough Designation for its Stentrode device in 2020, followed by a $40 million Series B in 2021. By the end of that year, the world witnessed the first social media post from a BCI user, Philip, on Twitter.

In 2022, the company attracted heavy hitters like Bill Gates, Jeff Bezos, and ARCH Venture Partners in a $75 million Series C, establishing BCI as more than just a science project. Since then, Synchron has published safety results, expanded its team, and forged partnerships with tech giants like Apple, Amazon, OpenAI, and NVIDIA.

The Deal Details: A Diverse Investor Base

The Series D round attracted a mix of new and returning investors. Double Point Ventures led the round, bringing its expertise in TechBio and digital health. The Australian National Reconstruction Fund (NRF), Qatar Investment Authority (QIA), K5 Global, Protocol Labs, and IQT also participated.

Notably, all existing investors, including ARCH, Khosla, Bezos, NTI, and Metis, reinvested. This demonstrates confidence in Synchron’s long-term prospects, especially given the scale of the fundraise. Oxley emphasized the significance of this commitment, stating that such backing is rare and speaks volumes about investor belief in the company’s vision.

Next-Generation BCI: Scaling Access and Coverage

Synchron’s expansion into San Diego marks the launch of a new R&D division, spearheaded by industry veterans Andy Rasdal and Mark Brister. The company aims to develop its next-generation system, a minimally invasive, transcatheter, high-channel-count, whole-brain interface.

This approach aligns with Synchron’s core thesis: scaling access to the brain without disrupting its architecture while generating more data for improved functionality. The company is essentially incubating a new startup within its existing structure, anticipating that technology leaps will be the hallmark of success in the BCI field.

The Market Landscape: Funding Surge and Emerging Trends

The BCI market is experiencing a surge in funding, but Oxley questions whether the AI-like valuations are sustainable. He anticipates a consolidation of the field, with motor control applications leading the way, followed by speech and vision interfaces.

Emerging trends include biohybrid interfaces and ultrasound-based BCI systems. Oxley also foresees a growth in neural data, from tens of thousands to millions of patient hours, driving better functionality and unlocking new regions of the brain.

Consumerization and Ethical Considerations

Oxley is optimistic about Apple’s potential to integrate attentional shifting and cognitive applications through AirPods, but less convinced about whole-brain implants for healthy individuals. He envisions BCI primarily as a tool for protecting or restoring cognitive decline with age, rather than enhancing superhuman capabilities.

The Path Forward: Regulatory Momentum and Long-Term Bets

Synchron’s Series D funding positions it as the closest BCI company to regulatory approval for its PMA. The company’s focus on speed to market and scalability, combined with its ongoing technology leaps, sets it apart from competitors.

The deal also signals a broader trend in BCI funding, with investors increasingly willing to back multiple companies in the space. Synchron’s long-term bet is not just on its own success but on the evolution of the entire industry.

The company’s future hinges on its ability to navigate regulatory hurdles, scale its manufacturing capabilities, and deliver on its promise of unlocking the brain’s computational power. The journey is far from over, but Synchron is poised to lead the way